Buying or Selling a Vehicle in Telangana? Do You Know the New Ownership Transfer Rules for 2025?

Telangana vehicle ownership transfer 2025: Learn about Forms 29, 30, Form 28 NOC, road tax, fees, documents, and timelines. Complete RTO guide.

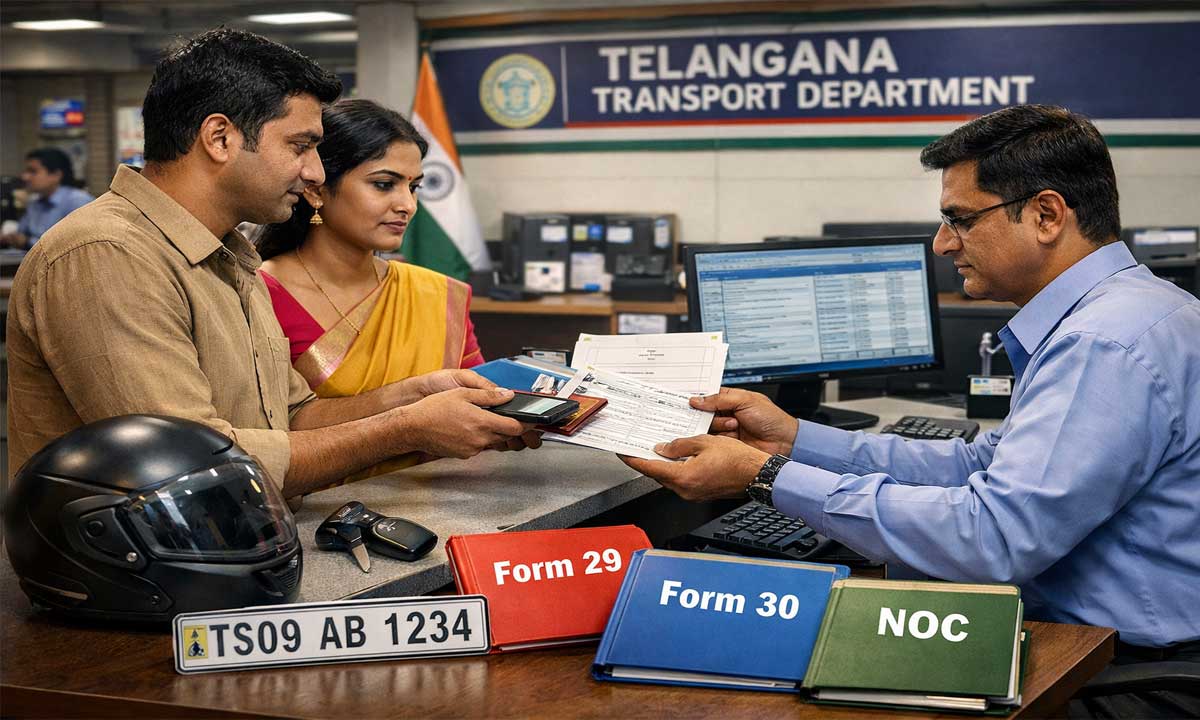

Telangana vehicle ownership transfer 2025 is mandatory for anyone buying or selling a car or bike in the state. The Telangana Transport Department follows CMVR 1989 Rule 55 and requires timely transfer using Forms 29, 30, and Form 28 NOC in inter-state cases. Delays can attract penalties ranging from ₹500 to ₹5,000.

Table of Contents

With most services now online, understanding the Telangana RTO ownership transfer process, documents, road tax rules, and timelines is essential to avoid fines and legal complications.

Vehicle Ownership Transfer in Telangana: Process Overview

Intra-State Transfer (Within Telangana)

If a vehicle is sold within Telangana, the ownership transfer is straightforward.

Steps to follow:

- Seller submits Form 29 (notice of transfer)

- Buyer applies with Form 30

- RTO verifies documents and issues a new RC

Timeline:

- Must be completed within 30 days of sale

Fees (Approx.):

- Cars: ₹530

- Bikes: ₹380

(Includes transfer fee, smart card fee, and postal charges)

Also Read: Hyderabad New Year Restrictions 2025: CP Sajjanar Announces Strict Checks, Heavy Penalties

Inter-State Transfer (Other State to Telangana)

If the vehicle is brought from another state, additional formalities apply.

Steps involved:

- Seller obtains Form 28 (NOC) from the original RTO

- Buyer pays Telangana road tax

- Re-registration under Telangana RTO

- Vehicle inspection and fitness check

Timeline:

- Ideal: 30 days

- Maximum allowed: 12 months

Costs:

- Road tax: 5%–15% of depreciated value

- Plus standard transfer and registration fees

Online Portal for Ownership Transfer

Applications can be submitted via the official website:

👉 transport.telangana.gov.in → Online Services → Ownership Transfer / NOC

Key features:

- Aadhaar and PAN linking

- Online fee payment

- SMS alerts for application status

More than 70% of vehicle ownership transfers in Telangana are now processed digitally.

Documents Required for Vehicle Ownership Transfer

Common Documents

- Original Registration Certificate (RC)

- Valid insurance policy

- Pollution Under Control (PUC) certificate

- PAN card or Form 60

- Address proof (Aadhaar/Voter ID)

- Chassis and engine pencil print

Seller

- Form 29 (duplicate copies)

- Affidavit if required

Buyer

- Form 30 (duplicate copies)

- Date of birth proof

Additional for Inter-State Transfers

- Form 28 (NOC)

- Previous state tax clearance

- Fitness certificate (commercial vehicles)

Financed Vehicles

- Form 35 and bank NOC mandatory

Inheritance or Death Cases

- Death certificate

- Legal heir affidavit

Road Tax & Re-Registration Rules in Telangana

For inter-state vehicles, road tax is calculated on depreciated vehicle value.

Example (Private Cars):

- Year 1 depreciation: 10%

- Year 5 depreciation: up to 50%

- Tax slab: 12%–15%

After tax payment:

- A new Telangana registration number is issued

- Hypothecation removal requires bank clearance

Common Mistakes That Cause Delays

- Expired insurance or PUC certificates

- Delay beyond 30 days after purchase

- Pending hypothecation with banks

- Fake or unverified NOC documents

Vehicle buyers are advised to verify records through the Parivahan portal to avoid fraud.

Latest Trends & Insights (2025)

- Hyderabad RTOs process 500+ ownership transfers daily

- Electric vehicle transfers are faster due to no fitness requirement

- Digital applications reduce dependency on agents

- Inter-state NOC delays remain a major complaint

- Rural vehicle transfers increased after local elections

Final Advice for Buyers and Sellers

Completing the Telangana vehicle ownership transfer within the prescribed time protects both buyer and seller from fines, legal disputes, and misuse of the vehicle. With online services widely available, timely and accurate documentation is the key to a smooth transfer.

Follow MunsifNews24x7 for more Information.