Markets Surge in Early Trade: Sensex and Nifty Gain on Blue-Chip Bank Stocks

"Indian markets surge as Sensex jumps 425 points and Nifty gains 123 points, led by blue-chip bank stocks. Explore key gainers, global cues, and market trends."

Mumbai: Indian stock markets witnessed a strong start on Thursday, with benchmark indices Sensex and Nifty surging, driven by robust buying in blue-chip bank stocks and positive cues from Asian markets.

Table of Contents

Sensex and Nifty Performance

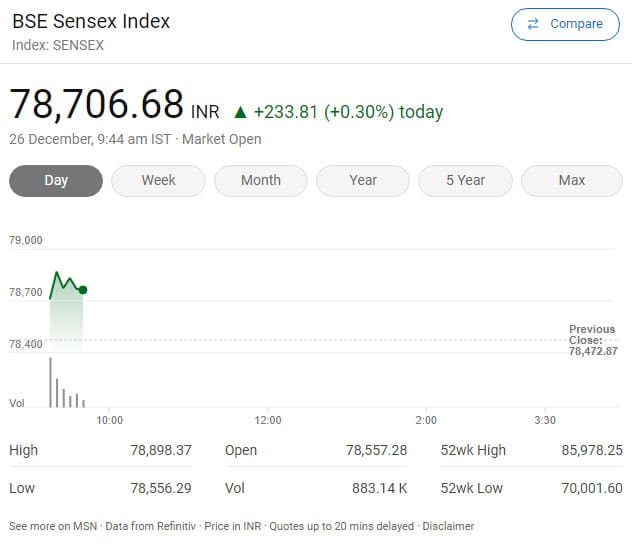

The BSE Sensex, comprising 30 leading stocks, jumped by 425.5 points to reach 78,898.37 in early trade. Similarly, the NSE Nifty climbed 123.85 points to touch 23,851.50. This marked a significant rebound after Tuesday’s muted session.

Key Gainers and Losers

Among the 30 blue-chip stocks, several notable gainers drove the market’s upward momentum:

- State Bank of India (SBI)

- Maruti Suzuki

- Axis Bank

- ICICI Bank

- Mahindra & Mahindra

- Power Grid Corporation

On the other hand, some stocks faced declines despite the market rally:

- Asian Paints

- Tech Mahindra

- Nestle India

- Tata Consultancy Services (TCS)

Positive Global Cues Boost Sentiment

Asian markets also traded in the green, providing a favorable backdrop for Indian indices:

- Seoul, Tokyo, and Shanghai reported gains as investors remained optimistic about regional economic recovery.

- US markets were closed on Wednesday for Christmas, adding to the reduced volatility in global trade.

Domestic Economic Recovery Underway

The Indian economy continues to recover from the slowdown observed during the September quarter. According to a recent Reserve Bank of India (RBI) bulletin, the recovery is being fueled by:

- Strong festival-related economic activity.

- Sustained growth in rural demand.

This positive outlook has further bolstered investor confidence in Indian markets.

FII Activity and Market Trends

Despite Thursday’s rally, Foreign Institutional Investors (FIIs) offloaded equities worth ₹2,454.21 crore on Tuesday, reflecting caution among global investors.

On Tuesday, the Sensex closed 67.30 points lower at 78,472.87, while the Nifty dipped 25.80 points to 23,727.65 after fluctuating throughout the session.

Also Read | Indian market opens in green amid positive mixed global cues

Brent Crude and its Impact

The global oil benchmark, Brent crude, saw a marginal increase of 0.41%, trading at $73.88 per barrel. Oil price fluctuations often influence Indian markets due to the country’s reliance on imports, making this a key indicator for future market trends.

Outlook for Indian Markets

The robust start to Thursday’s trading session highlights investor optimism, particularly in banking and financial stocks, which play a crucial role in driving market performance. Factors contributing to the bullish sentiment include:

- Positive cues from Asian peers.

- Renewed confidence in India’s economic recovery.

- Strength in blue-chip stocks such as SBI and ICICI Bank.

A Promising Start to the Day

The Indian stock markets are showing signs of resilience as blue-chip stocks lead the rally. Investors are encouraged to monitor sectoral trends and global developments closely, especially as economic recovery gains momentum.

Stay tuned for live updates and in-depth market analysis to navigate the evolving financial landscape effectively.