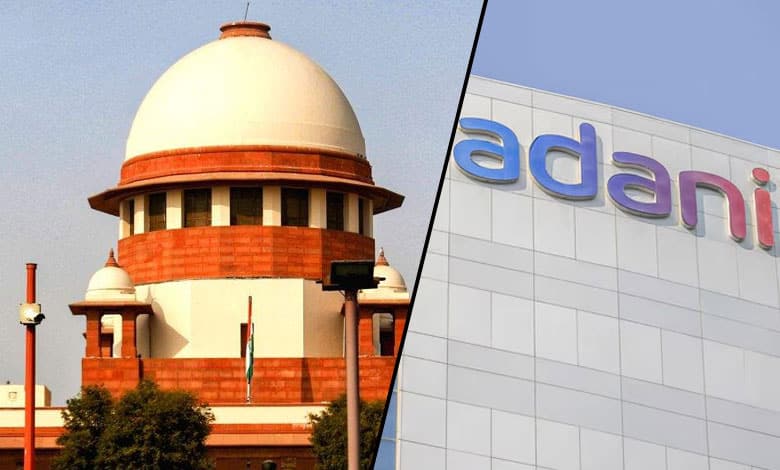

Supreme Court Dismisses Plea on Adani-Hindenburg Controversy Investigation

"Supreme Court dismisses plea seeking SEBI's conclusive report on the Adani-Hindenburg controversy, upholding ongoing investigations and emphasizing due process."

New Delhi: The Supreme Court of India has dismissed a plea seeking intervention in the ongoing investigation into the Adani-Hindenburg controversy.

This decision upholds an earlier order from the apex court registry, passed in August 2024, which rejected a lawyer’s application demanding the Securities and Exchange Board of India (SEBI) submit its conclusive report on the matter.

Table of Contents

Background of the Case

Advocate Vishal Tiwari had filed an appeal challenging the registry’s decision dated August 5, 2024. This appeal followed SEBI’s extensive investigation into allegations made against the Adani Group, stemming from the report by Hindenburg Research.

The Hindenburg report accused the Adani Group of stock manipulation and financial irregularities, triggering debates about regulatory oversight in India’s securities market.

Previously, on July 15, 2024, the Supreme Court had dismissed a review petition that sought the formation of a Special Investigation Team (SIT) or expert panel to investigate the allegations.

A bench led by then-Chief Justice of India D.Y. Chandrachud, along with Justices J.B. Pardiwala and Manoj Misra, found no merit in the review petition, stating, “No error apparent on the face of the record.”

The court had emphasized that SEBI was already conducting a comprehensive probe and rejected calls for duplicative investigations.

Key Observations by the Supreme Court

- Third-Party Reports Not Conclusive Evidence:

In its detailed judgment issued on January 3, 2025, the Supreme Court clarified that reports from third-party organizations, such as the Organized Crime and Corruption Reporting Project (OCCRP) and Hindenburg Research, cannot be considered conclusive proof of wrongdoing. The court underscored that unverified materials lack the credibility required for a judicial inquiry. - Criticism of Unresearched PILs:

The apex court cautioned against public interest litigations (PILs) relying on unverified reports or unrelated materials, labeling such efforts as “counterproductive.” The bench noted that poorly researched petitions distract from meaningful legal proceedings and undermine the credibility of the PIL mechanism. - Progress of SEBI’s Investigation:

The court recognized that SEBI had completed 22 of the 24 investigations into allegations against the Adani Group. For the remaining two cases, SEBI had sought information from foreign entities and agencies. The Supreme Court directed SEBI to expedite its investigation and submit its findings within three months. - Strengthening the Regulatory Framework:

While dismissing the plea, the Supreme Court advised the Indian government to consider the recommendations made by the expert panel headed by retired Justice A.M. Sapre. The court emphasized the importance of fortifying the regulatory framework to protect investors and maintain the stability of India’s securities market. It urged SEBI and other investigative agencies to address allegations of short selling and its impact on investor confidence.

Government and SEBI’s Response

The Government of India and SEBI are expected to take further actions to strengthen regulatory oversight and investor protection.

SEBI’s investigation into the Adani Group includes scrutinizing alleged instances of stock manipulation and irregular trading practices.

In its previous statement, SEBI clarified that it is committed to conducting a transparent and impartial investigation.

The market regulator also highlighted its reliance on international cooperation to gather evidence related to the remaining cases.

Also Read | Supreme Court to consider admission of Rohingya children in MCD schools

Implications of the Verdict

The Supreme Court’s decision reiterates the judiciary’s confidence in SEBI’s capabilities to conduct a thorough and impartial probe.

The dismissal of repeated pleas for independent investigations reflects the court’s unwillingness to undermine the ongoing processes led by regulatory authorities.

Additionally, the verdict highlights the importance of responsible litigation practices. It signals that the judiciary will not entertain petitions based on speculative or unverified claims, especially in cases with wide-ranging economic implications.