Telangana GST (Amendment) Bill 2026 Tabled in Assembly to Align with National GST Framework

The Telangana GST (Amendment) Bill, 2026 was introduced in the Assembly to align state GST laws with GST Council recommendations, strengthen administration, and ensure uniform tax implementation.

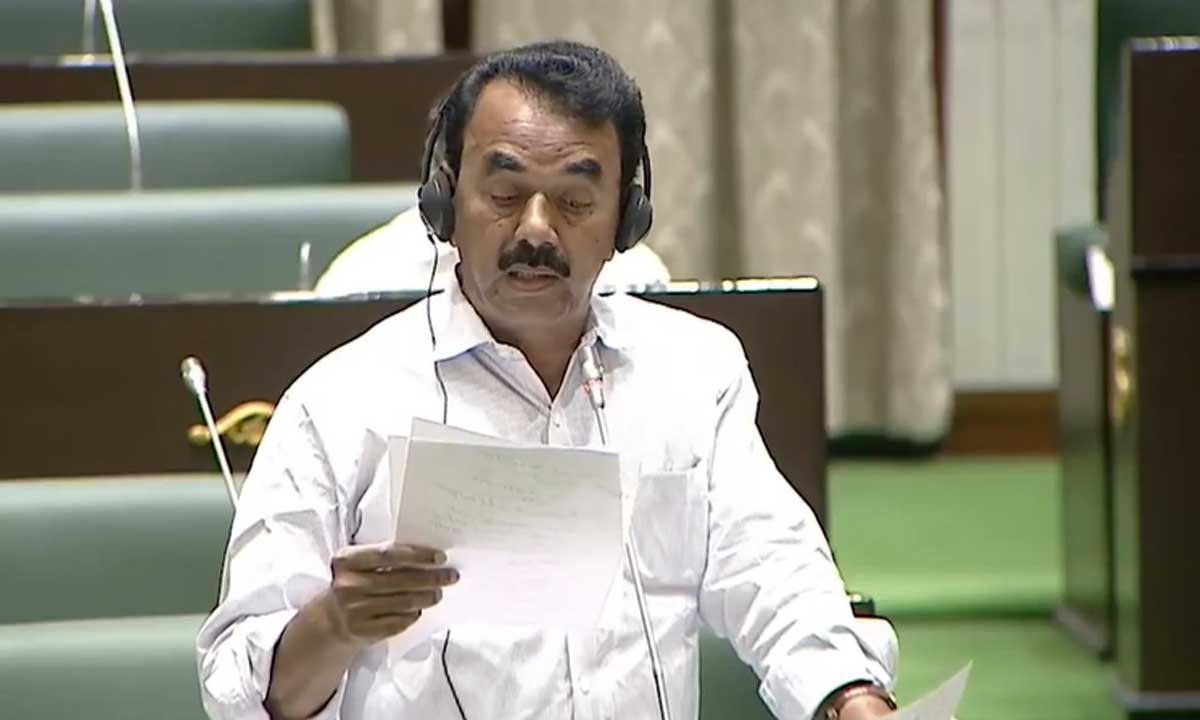

Hyderabad: The Telangana government on Monday introduced the Telangana Goods and Services Tax (Amendment) Bill, 2026 in the State Legislative Assembly, aiming to bring state GST laws in line with national GST Council recommendations. The Bill was moved by Jupally Krishna Rao, Minister for Tourism, Culture and Excise, on behalf of Chief Minister A. Revanth Reddy.

Table of Contents

The proposed amendments seek to ensure uniform GST implementation, improve administrative clarity, and strengthen compliance across Telangana.

Why the Telangana GST (Amendment) Bill, 2026 Matters

While presenting the Bill, the Minister explained that the changes are based on recommendations of the Goods and Services Tax Council, a constitutional body that periodically reviews GST implementation and suggests updates to maintain consistency nationwide.

He informed the House that the GST Council, in its 51st to 55th meetings, recommended several amendments to the Central GST Act, Integrated GST Act, and related rules. Although the Centre implemented these changes, similar updates were pending in some states, including Telangana.

Ordinance Replaced to Meet GST Council Deadline

The GST Council had directed all states to complete amendments to their State GST Acts by September 30, 2025. In compliance, the Telangana government promulgated Ordinance No. 6 of 2025, published on November 11, 2025.

The Telangana GST (Amendment) Bill, 2026 now seeks to replace that Ordinance through legislative approval.

Key Highlights of the Telangana GST (Amendment) Bill, 2026

The Minister outlined several important provisions included in the Bill:

- Section 74A introduced to allow reclassification of assessment proceedings between fraud and non-fraud cases, based on facts

- Extra Neutral Alcohol used in liquor manufacturing kept outside GST, in line with a Supreme Court ruling

- Replacement of the term “plant or machinery” with “plant and machinery” to address issues arising from the Safari Retreats judgment

- Special GST compliance procedures for pan masala and tobacco manufacturers

- Clear rules for distribution of input tax credit by Input Service Distributors (ISD)

Clarity on Definitions and Appeals

To remove ambiguity, the Bill amends definitions such as:

- Input Service Distributor

- Local fund

- Municipal fund

It also introduces changes related to:

- Appeals before the first appellate authority

- GST Appellate Tribunals

- Registration procedures

- Taxability of vouchers

- Return filing

- Summons and e-commerce operations

Government Says Amendments Will Strengthen GST Administration

The Minister stated that the amendments would:

- Improve clarity in GST provisions

- Strengthen tax administration

- Ensure consistency with the national GST framework

He added that the Bill is designed to support smoother GST operations while reducing disputes and interpretation issues for businesses and tax authorities alike.

Follow MunsifNews24x7 for more Information.