10 Common Cyber Scams You Should Be Aware Of: Protect Your Money

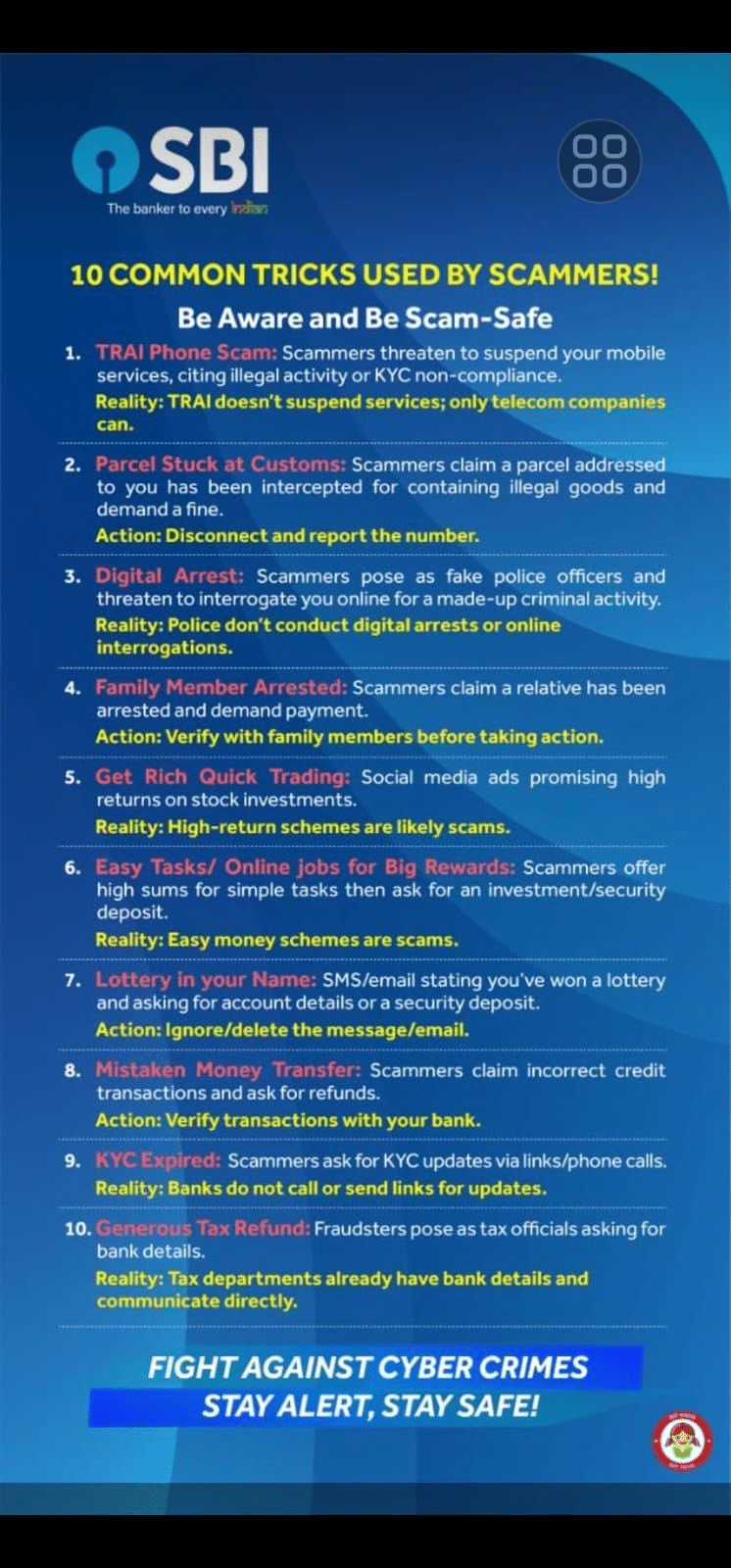

The State Bank of India (SBI) has issued a crucial advisory to help the public recognize and avoid common cybercrimes, which have become a rising concern. With an increasing number of fraudsters using sophisticated methods to deceive people, the bank has shared a list of 10 common scams that people should be aware of to prevent falling victim to cybercriminals.

Table of Contents

1) TRAI Phone Scam

Scammers often impersonate officials from the Telecom Regulatory Authority of India (TRAI) and claim that their mobile services will be suspended due to alleged illegal activities or KYC non-compliance. However, SBI clarifies that only telecom companies, not TRAI, can suspend mobile services.

2) Parcel Stuck at Customs

Another common scam involves fraudsters calling and claiming that a parcel meant for you is stuck at customs due to illegal goods inside. They demand a fine in exchange for releasing the parcel. Such numbers should be immediately reported to authorities.

3) Digital Arrest Threat

It is a well-known scam where fraudsters pose as police officers and threaten to arrest you for fabricated criminal activities. The police, however, do not conduct “digital arrests” or online interrogations, making this a clear sign of a scam.

4) Family Member Arrested

In this scam, fraudsters claim that a relative or family member has been arrested and demand money for bail or legal fees. The advisory urges victims to verify such claims with their families before making payments.

5) Get Rich Quick Trading

Scammers promote high-return investment opportunities on stocks, often via social media ads. These “get rich quick” schemes are typically scams designed to steal money from unsuspecting victims.

6) Easy Tasks/Online Jobs for Big Rewards

Fraudsters promise large sums of money for performing simple online tasks, only to ask for an upfront security deposit. SBI advises people to avoid such offers, as they are almost always scams.

7) Lottery in Your Name

Receiving unsolicited messages or emails claiming you’ve won a lottery is a common scam. These fraudsters often ask for personal details or a security deposit to release the supposed winnings.

Also Read: Bank Alert: If You Don’t Know These Important Rules, You Could Lose Your Money

8) Mistaken Money Transfer

Scammers may contact you, claiming that an incorrect amount has been transferred to your account and ask for a refund. Always verify such requests with your bank before taking any action.

9) KYC Expired

Fraudsters often pose as bank representatives and call or send links asking for KYC updates. However, banks never call or send links for KYC updates, making such requests a red flag for scams.

10) Generous Tax Refund

Scammers may impersonate tax officials and request bank details, claiming you are due for a tax refund. SBI reminds the public that tax authorities already have your bank information and never ask for it via unsolicited calls or emails.

The advisory was also shared by Nilesh Shah, the Managing Director of Kotak Mutual Fund, on X (formerly Twitter), where he emphasized the importance of caution. “Whatever shines is not necessarily gold,” he wrote, urging the public to stay alert and aware of these fraudulent tactics.

In conclusion, SBI advises everyone to be cautious when receiving unsolicited calls, messages, or emails, especially those asking for personal information or payments.