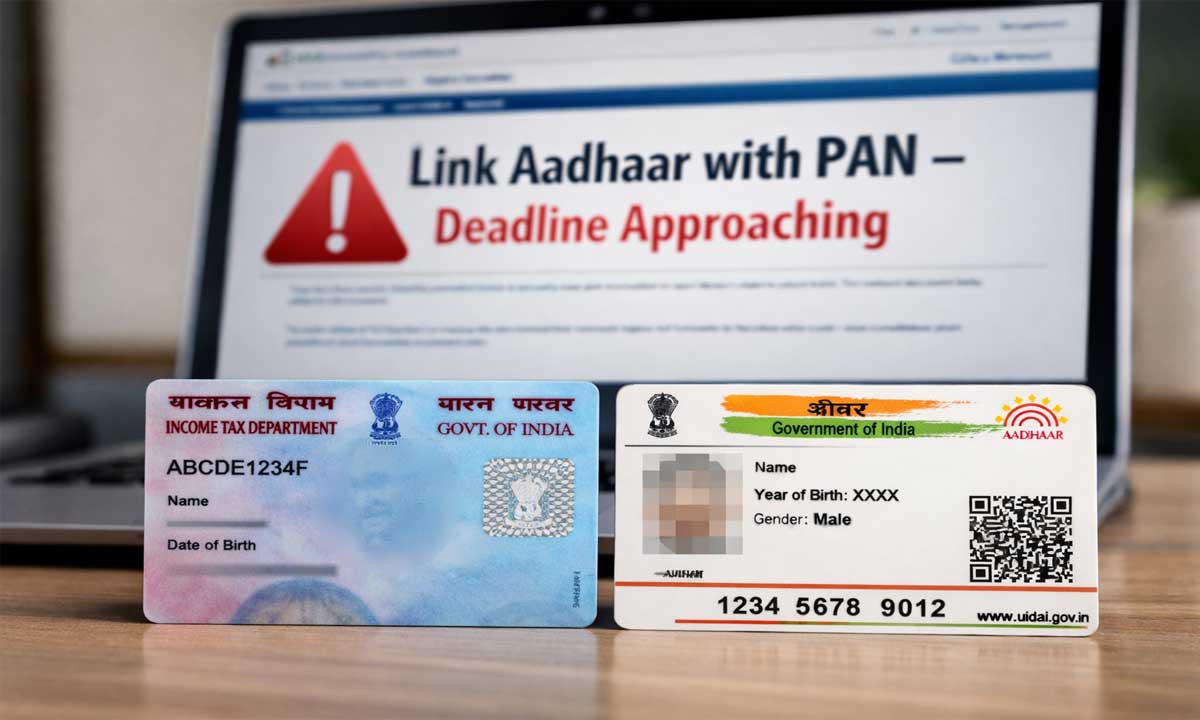

Final Deadline to Link Aadhaar With PAN: Step-by-Step Online Process, Late Fees, and What Happens If You Miss It

PAN Aadhaar link deadline extended to December 31, 2025. PAN may become inoperative from January 1, 2026, affecting tax filing, refunds, and banking services.

Your PAN card may stop working if you fail to link it with Aadhaar before December 31, 2025. The latest directive warns of tax filing issues, higher TDS, and blocked financial services from January 2026.

Table of Contents

PAN Aadhaar Link Deadline 2025: Why It Matters

The PAN Aadhaar link has become a mandatory requirement under Indian tax laws. If PAN is not linked with Aadhaar within the prescribed deadline, the PAN card may become inoperative, causing major problems in tax filing, refunds, and financial transactions.

As per the latest directive, individuals who obtained their PAN using an Aadhaar enrolment ID must complete the PAN Aadhaar linking by December 31, 2025. Failure to do so will make the PAN inoperative from January 1, 2026.

Also Read: Studying Abroad Gets Tougher as Canada, UK, US Tighten Student Visa Rules

Who Must Link PAN and Aadhaar

Under Section 139AA of the Income Tax Act, the following individuals must complete the PAN Aadhaar link:

- Individuals allotted PAN on or before July 1, 2017

- Those eligible to obtain an Aadhaar number

- Taxpayers filing income tax returns

- Individuals involved in investments or high-value financial transactions

Failure to link PAN and Aadhaar will restrict access to several tax and banking services.

PAN Aadhaar Link Deadline: Latest Update

Key timeline highlights

- Original deadline: June 30, 2023

- Extended deadline with penalty: May 31, 2024

- Special extension till December 31, 2025 for PANs issued using Aadhaar enrolment ID

For this specific category, no penalty will be charged if the PAN Aadhaar link is completed before December 31, 2025.

However, other PAN holders who missed earlier deadlines may still need to pay a ₹1,000 late fee.

What Happens If You Don’t Link PAN with Aadhaar

Failing to meet the PAN Aadhaar link deadline can lead to serious consequences:

- PAN becomes inoperative

- Income tax returns cannot be filed

- Tax refunds will not be issued

- Higher TDS/TCS deductions apply

- Forms like 15G and 15H will not be accepted

- Banking and investment services may be blocked

- Mutual funds, stock trading, and KYC services may be suspended

An inoperative PAN also means refunds and interest on refunds may not be processed.

How to Link PAN and Aadhaar Online

You can complete the PAN Aadhaar link online using these steps:

- Visit the Income Tax e-filing portal

- Click on “Link Aadhaar” under Quick Links

- Enter PAN, Aadhaar number, and name

- Verify details using OTP

- If required, pay ₹1,000 late fee via e-Pay Tax

- Submit the request

The PAN Aadhaar link status usually updates within 3–5 working days.

What If Your PAN Is Already Inoperative

If your PAN has already become inoperative, it can still be reactivated:

- Visit the Income Tax portal

- Pay ₹1,000 penalty through e-Pay Tax

- Complete the PAN Aadhaar linking process

- PAN usually becomes operative again within 30 days

Until reactivation, avoid high-value transactions.

The December 31, 2025, PAN Aadhaar link deadline is crucial, especially for individuals who obtained PAN using an Aadhaar enrolment ID. Missing this deadline will result in PAN becoming inoperative from January 1, 2026, leading to blocked tax filings, higher tax deductions, and disrupted financial services.

To stay compliant and avoid inconvenience, check your PAN Aadhaar link status now and complete the process well before the deadline.