How to Instantly Obtain a PAN Card Using Aadhaar Details: A Step-by-Step Guide

Applying for a PAN card has become incredibly simple and quick with the introduction of the e-PAN service. Gone are the days when obtaining a PAN card involved a lengthy process of printing, postage, and manual handling. Now, with just your Aadhaar details, you can get a PAN card in minutes.

Applying for a PAN card has become incredibly simple and quick with the introduction of the e-PAN service. Gone are the days when obtaining a PAN card involved a lengthy process of printing, postage, and manual handling. Now, with just your Aadhaar details, you can get a PAN card in minutes.

What is PAN and Why is it Important?

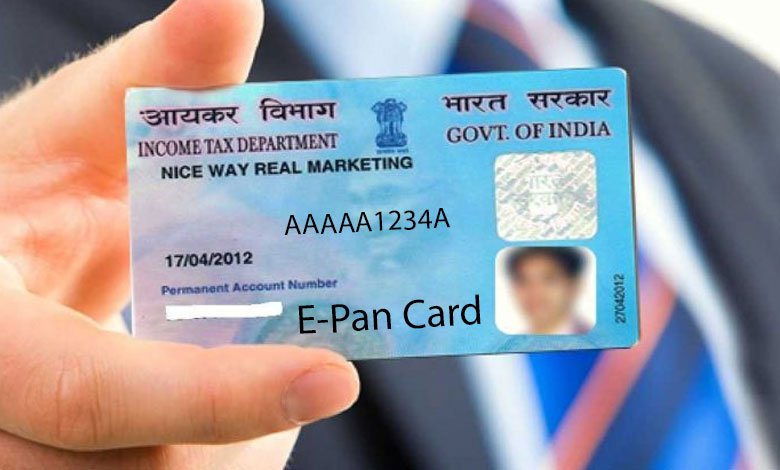

A Permanent Account Number (PAN) is a unique ten-digit alphanumeric identifier issued by the Income Tax Department of India. It is essential for various financial activities, including filing income tax returns, conducting large transactions, and fulfilling KYC (Know Your Customer) requirements.

Introducing e-PAN: The Modern Solution

With the advent of e-PANs, the process has been streamlined, allowing individuals to receive their PAN cards electronically in a PDF format. This service is not only fast but also free of cost, making it accessible to a larger population.

Benefits of e-PAN

- Quick and Paperless: The entire process is digital, requiring no paperwork.

- Linked to Aadhaar: All you need is an Aadhaar number and a mobile number linked to it.

- Legally Valid: e-PANs are recognized for all purposes where a PAN is required, such as tax filing and financial transactions.

Who Can Apply for an e-PAN?

The Instant e-PAN service is available to individual taxpayers who do not already have a PAN but possess an Aadhaar number. This service can be accessed even without logging into the e-filing portal, making it incredibly user-friendly.

Steps to Get an e-PAN

Here’s how you can instantly obtain an e-PAN using your Aadhaar details:

- Visit the e-Filing Portal: Go to the Income Tax Department’s e-filing portal: https://www.incometax.gov.in/iec/foportal/.

- Access the Instant e-PAN Service:

- On the homepage, click on “Instant e-PAN.”

- On the e-PAN page, select “Get New e-PAN.”

- Enter Aadhaar Details:

- Input your 12-digit Aadhaar number.

- Confirm the details by selecting the checkbox and click “Continue.” Note: If your Aadhaar is already linked to a PAN, you’ll receive a notification. If your Aadhaar is not linked to a mobile number, you’ll need to link it first.

- OTP Validation:

- Agree to the consent terms and click “Continue.”

- Enter the 6-digit OTP sent to your Aadhaar-linked mobile number and validate your Aadhaar details with UIDAI.

- Submit the Request:

- On the validation page, accept the terms and click “Continue.”

- Upon successful submission, you’ll receive an Acknowledgement Number, which you should retain for future reference. A confirmation message will also be sent to your registered mobile number.

Conclusion

With the e-PAN service, getting a PAN card has never been easier. In just a few minutes and with minimal effort, you can obtain your PAN, which is crucial for financial transactions and tax purposes. The digital age has truly made bureaucratic processes faster and more efficient, and the e-PAN is a perfect example of this transformation.