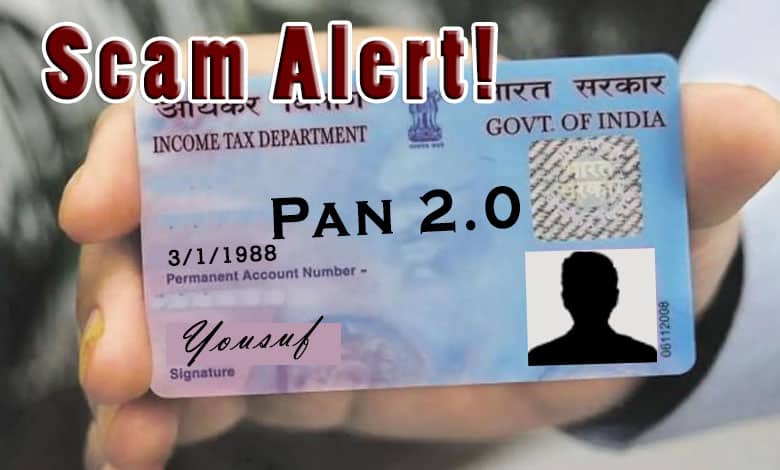

PAN 2.0 Scam Alert: ‘Upgrades’ and ‘Fast Services’ for a Fee? Here’s What You Need to Know

If you already possess a valid PAN card, there is no need to worry. PAN 2.0 does not require individuals to obtain a new PAN card unless they wish to update personal information, such as a change in name or date of birth.

The government’s rollout of PAN 2.0 promises enhanced security and convenience in India’s Permanent Account Number (PAN) system. With exciting upgrades like improved data security, a QR code for easy information access, and a unified portal for PAN and TAN services, the new PAN system aims to streamline financial processes. However, the public’s curiosity about these changes has opened the door for fraudsters looking to exploit unsuspecting individuals.

Table of Contents

What is PAN 2.0?

The PAN 2.0 update focuses on modernizing the existing PAN card system with improved security features. The major upgrades include a secure data vault for storing personal information and a QR code that allows easy access to PAN details. Additionally, a single portal has been created to manage both PAN and TAN services, offering a more seamless experience for users.

Do You Need a New PAN Card?

If you already possess a valid PAN card, there is no need to worry. PAN 2.0 does not require individuals to obtain a new PAN card unless they wish to update personal information, such as a change in name or date of birth. You can easily apply for a reprint or make updates. The cost for a reprint is Rs. 50 for domestic addresses, with additional postage charges for international deliveries.

How Scammers Are Exploiting PAN 2.0

With the buzz surrounding PAN 2.0, fraudsters are taking advantage of the situation by misleading individuals. They may contact victims via phone calls, emails, or messages, falsely claiming that upgrading to PAN 2.0 is mandatory. These scammers often demand payment for processing upgrades or promise expedited services for a fee. In some cases, they may share phishing links or ask for sensitive personal details, including OTPs and bank information, to carry out fraudulent activities.

How to Protect Yourself from PAN 2.0 Scams

- Know the Facts: It’s important to note that it is not mandatory to apply for a new PAN card under PAN 2.0, unless you need to update your details.

- Avoid Suspicious Contacts: Be cautious of unsolicited calls, emails, or messages claiming to offer upgrades for a fee. Official PAN services do not ask for payment in this manner.

- Never Share Sensitive Information: Do not share your OTP, bank details, or personal information with anyone claiming to represent PAN services, unless you’re certain it’s from an official source.

- Stay Away from Phishing Links: Avoid clicking on unverified links that claim to offer PAN card upgrades or services.

Also Read: What is Masked Aadhaar? Is It Accepted Everywhere? How to Download It – All You Need to Know

Where to Get Verified Information

For official updates on PAN 2.0, always refer to the Income Tax Department’s official website. Requests for new PAN cards, reprints, or updates should be made through authorized websites, such as Protean (formerly NSDL) or UTIITSL. Be wary of third-party websites or agents offering PAN services.

What to Do If You Fall Victim to PAN 2.0 Fraud

If you suspect you’ve fallen victim to fraud, take immediate action. Report the incident through the National Cyber Crime Reporting Portal or call the helpline in 1930. Ensure you retain all evidence of fraudulent communication, including call logs, emails, and messages, to support any investigations.

Conclusion: Stay Vigilant and Secure Your Information

While PAN 2.0 brings significant improvements to the Indian financial system, it also increases the opportunities for scammers. Staying informed, avoiding suspicious offers, and using only official channels will help you stay safe from fraud. Remember, official PAN services will never demand payment through unsolicited calls or messages. By protecting your personal information and staying cautious, you can enjoy the benefits of PAN 2.0 without falling victim to fraud.