How to Check if Your Aadhaar is Linked to Your PAN Card

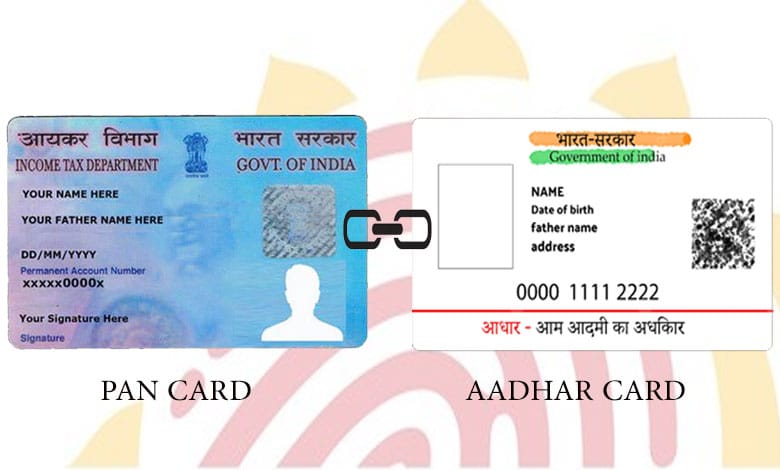

In India, linking your Aadhaar number with your Permanent Account Number (PAN) card is crucial for various financial and tax-related activities.

In India, linking your Aadhaar number with your Permanent Account Number (PAN) card is crucial for various financial and tax-related activities. With the deadline for linking approaching, many individuals are eager to verify their Aadhaar-PAN linkage status. Here’s a comprehensive guide on how to check if your Aadhaar is linked to your PAN card.

Why Linking Aadhaar with PAN is Important

The Indian government has mandated the linking of Aadhaar with PAN to streamline tax compliance and curb tax evasion. As of June 30, 2023, taxpayers were required to link their Aadhaar with their PAN cards. Failing to do so would render PAN cards inoperative starting July 1, 2023. If you find that your Aadhaar is not linked to your PAN, you may incur a penalty of Rs. 1,000 when you link them.

Steps to Check Aadhaar-PAN Link Status Online

To verify if your Aadhaar is linked with your PAN card, follow these steps:

- Visit the Income Tax E-Filing Portal: Navigate to the official website: Income Tax E-Filing.

- Access Quick Links: On the left side of the homepage, click on “Quick Links”.

- Select ‘Link Aadhaar Status’: From the dropdown menu, click on “Link Aadhaar Status”.

- Enter Your Details: You will be prompted to enter your 10-digit PAN number and your 12-digit Aadhaar number.

- View Link Status: Click on “View Link Aadhaar Status”. If your Aadhaar number appears, it indicates that your PAN and Aadhaar are already linked.

Alternative Methods to Check Aadhaar-PAN Link Status

If you prefer to check your Aadhaar-PAN link status through other means, consider the following options:

- Offline Method: You can visit your local income tax office and inquire about your Aadhaar-PAN linkage status.

- SMS Service: The government also provides SMS services for checking your link status. You can send a text message with your details to the designated number (available on the official income tax website).

Conclusion

With the approaching deadline for linking Aadhaar with PAN cards, it is essential to verify your linkage status to avoid any penalties or complications. The process is straightforward and can be completed online in just a few minutes. Make sure to complete this essential task to ensure your PAN card remains active and compliant with government regulations.