Pakistan’s Debt Crisis Deepens: Will UAE’s $2 Billion Rollover Be Enough?

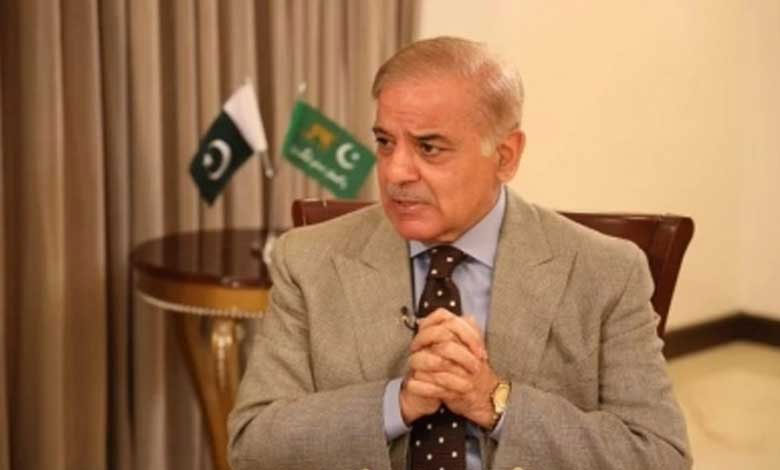

Prime Minister Shehbaz Sharif announced on Tuesday that the United Arab Emirates (UAE) has agreed to roll over a $2 billion loan that Pakistan was due to repay this month.

Islamabad: Prime Minister Shehbaz Sharif announced on Tuesday that the United Arab Emirates (UAE) has agreed to roll over a $2 billion loan that Pakistan was due to repay this month.

Table of Contents

UAE President Confirms Loan Extension

During a cabinet meeting, PM Sharif revealed that UAE President Mohamed bin Zayed personally conveyed this decision during their one-on-one meeting in Rahim Yar Khan over the weekend. The UAE leader was on a private visit to the city in Punjab province but also met Pakistan’s premier.

“He happily informed me that the $2 billion owed by Pakistan in January was being extended. He proposed it himself and immediately issued directives,” PM Sharif stated.

Pakistan’s Economic Challenges and Debt Repayments

Pakistan’s foreign exchange reserves have increased from $2.7 billion to $11.7 billion in the last two years. However, the country’s external public debt remains at $100 billion, the same as two years ago.

Though PM Shehbaz did not specify the new repayment timeline, such loan rollovers are typically for one year. Both UAE and Saudi Arabia have historically provided financial support to help Pakistan manage its balance of payments crisis.

Saudi Arabia’s $3 Billion Debt Extension

In December 2023, Saudi Arabia extended the repayment period for a $3 billion deposit after Pakistan was unable to pay. The State Bank of Pakistan (SBP) confirmed that Saudi Arabia had initially placed the deposit in 2021 and rolled it over in 2022 and 2023.

According to government officials, Pakistan will need debt extensions until at least June 2025 to manage $13 billion in repayments due to Saudi Arabia, China, and the UAE.

Also Read: US Demands Action: Will Bangladesh Release Al-Qaeda Operative Wanted by America?

PM Shehbaz Sharif Optimistic About Economic Stability

During Tuesday’s meeting, PM Shehbaz expressed satisfaction over economic stability and emphasized the need for continued efforts to boost Pakistan’s financial outlook.

However, he pointed out that reducing electricity tariffs is crucial for the growth of industries and agriculture.

Pakistan’s IMF Agreement and Revenue Targets

Pakistan is striving to increase revenue collection under its agreement with the International Monetary Fund (IMF). The country secured a $7 billion loan package in September 2024 and has set an ambitious tax revenue target of Rs 12.913 trillion for FY 2024-25, marking a 40% increase from the previous year.

However, the Federal Board of Revenue (FBR) has already missed its first-quarter target, falling Rs 96 billion short by collecting Rs 2,556 billion instead of Rs 2,652 billion.

Boost in Exports and Indonesia’s Upcoming Visit

PM Shehbaz also welcomed growth in textile exports and emphasized the importance of an export-led economic strategy. He urged efforts to expand exports to non-traditional markets.

Additionally, he announced that Indonesia’s President is expected to visit Pakistan later this month. Discussions will focus on bilateral trade, with Pakistan exploring opportunities to export halal meat and rice to Indonesia.

Pakistan continues to navigate economic challenges while securing critical financial support from its key allies, including the UAE and Saudi Arabia. The recent $2 billion loan extension from the UAE provides some relief, but Pakistan’s long-term economic stability will depend on its ability to increase exports, attract investment, and meet IMF targets.