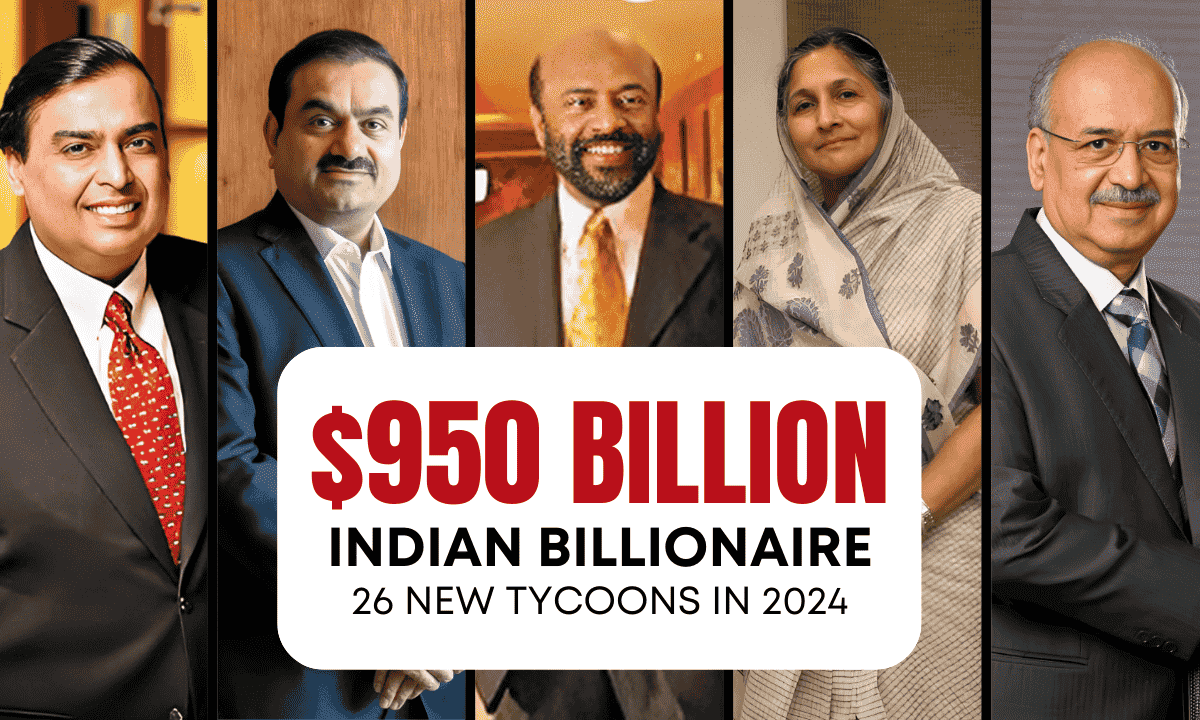

India’s Billionaire Rises 6% in 2024 with $950B Wealth, 26 New Tycoons: Check The List

India’s billionaire wealth hits $950 billion in 2024, with 26 new tycoons joining the ranks. Discover the sectors and innovators driving this historic surge.

Mumbai, March 5, 2025 – India’s billionaire population surged to 191 in 2024, fueled by booming entrepreneurship, tech innovation, and stock market gains, according to Knight Frank’s 2025 Wealth Report. The combined wealth of Indian billionaires now stands at $950 billion, cementing the country’s position as the third-largest billionaire hub globally, trailing only the US ($5.7 trillion) and China ($1.34 trillion).

Table of Contents

Key Highlights: India’s Wealth Surge

- Billionaire Growth: 26 new billionaires added in 2024, up from just 7 in 2019.

- HNWI Expansion: High-net-worth individuals (assets over $10 million) rose 6% to 85,698.

- Global Rankings:

- 3rd in billionaire wealth ($950 billion).

- 4th in HNWI count (85,698), behind the US, China, and Japan.

- Projection: HNWIs expected to reach 93,753 by 2028.

India’s Top 5 Richest in 2024

| Rank | Name | Net Worth (USD) | Source of Wealth |

|---|---|---|---|

| 1 | Mukesh Ambani | $95.4 billion | Reliance Industries |

| 2 | Gautam Adani | $62.3 billion | Adani Group |

| 3 | Shiv Nadar | $42.1 billion | HCL Enterprise |

| 4 | Savitri Jindal | $38.5 billion | O.P. Jindal Group |

| 5 | Dilip Shanghvi | $29.8 billion | Sun Pharmaceuticals |

Also Read: Indian Billionaire Gautam Adani Visits Ajmer Sharif Dargah …

2024’s New Billionaires: Innovators and Legacy Builders

India’s 26 new billionaires reflect a mix of generational businesses and young disruptors:

Pharma & Healthcare Titans

- B Partha Saradhi Reddy ($3.95B): Hetero Labs (generic drug giant).

- Naresh Trehan ($1.4B): Medanta Hospitals (healthcare pioneer).

- Subbamma Jasti ($1.1B): Divi’s Laboratories (pharma exports).

Green Energy Champions

- Surender Saluja ($3.4B): Premier Energies (solar solutions).

- Gautam Adani: Expanded into hydrogen energy, boosting his wealth by 18%.

Youngest Entrants

- Kaivalya Vohra (21) & Aadit Palicha (22): Zepto’s instant delivery app ($3.6B valuation).

Consumer Goods & Real Estate Moguls

- Kabir Mulchandani ($2B): FIVE Holdings (luxury Dubai real estate).

- Irfan Razack ($1.8B): Prestige Group (Bengaluru’s skyline architect).

What’s Driving India’s Wealth Growth?

- Stock Market Boom: The BSE Sensex surged 30% in 2024, inflating asset values for 80% of India’s top 100 richest.

- Tech & Startups: Over 100 unicorns in fintech, AI, and EVs.

- Policy Reforms: Tax incentives for green energy and infrastructure attracted $82B FDI.

- Global Investments: Luxury real estate and equities diversification.

Shishir Baijal, Chairman of Knight Frank India, stated:

“India’s economic resilience and sophisticated investment strategies—from startups to sustainable energy—are reshaping global wealth dynamics.”

Also Read: Top 10 Richest Muslims in the World, Two Indians in Top 5

Sector-Wise Wealth Breakdown

- Pharma Dominance: Dilip Shanghvi’s Sun Pharma hit $29.8B; Torrent Pharma’s Mehta brothers doubled wealth to $16.3B.

- Renewables: Adani Green Energy added $12B to Gautam Adani’s net worth.

- Luxury Real Estate: Mumbai and Delhi property prices rose 22% in premium sectors.

India vs Global Peers (2024)

| Country | Billionaire Wealth | HNWI Growth Rate |

|---|---|---|

| USA | $5.7 trillion | 3.5% |

| China | $1.34 trillion | 4.1% |

| India | $950 billion | 6% |

Future Outlook: Billionaires to Cross 250 by 2030

Knight Frank projects India’s wealth expansion will accelerate due to:

- Tech Innovations: AI, space tech, and electric vehicles.

- Policy Boost: Simplified GST for startups and infrastructure grants.

- Youth Power: 65% of the population under 35 driving consumer and tech markets.

India’s wealth revolution is redefining its global economic stature, with billionaires and HNWIs leveraging innovation and diversification. As the country eyes a $7 trillion GDP by 2030, its role in shaping worldwide wealth trends remains undeniable.

(This article is independently sourced by Munsif. All data verified via Knight Frank and Forbes.)